Teaching children about budgeting and saving

Budgeting and saving are two essential skills for every person, closely tied to financial literacy. It is important to start teaching children about budgeting and saving so that they feel responsible for their money and prepare for adulthood. Healthy monetary habits will help them later in life and will assist them in making well-thought-out financial decisions. The sooner children learn to save and budget, the better. Keep reading to learn about top tips to help.

Why it is significant to teach children saving and budgeting

When parents start teaching their children about budgeting and saving, the children acquire important money-related knowledge and relevant skills, putting them in control of their own funds. Children will understand finances and know that money is not unlimited. It is significant that they learn how to make smart choices and how their decisions may affect various aspects of their daily lives.

Budgeting is a relevant and valuable skill for young children to learn. They will better deal with credit cards, mortgages, or personal loans in the future. Having a budget means they can cope with spending and saving. Children who know how to budget will most likely avoid debt in the future. Saving is also essential. Parents should discuss the need to set some cash aside for long-term goals. Later, the children will understand the need to save for retirement, for cash app investing, or for a down payment to purchase their own home.

Tips to teach budgeting to children

It is necessary to start learning at an early age so that financial habits have time to develop. Of course, it does not mean children will be really interested in budgeting, but this knowledge is essential for their future. Here are the top tips for teaching budgeting to children.

Discuss wants and needs

There is a difference between needing and wanting certain things. Discuss this difference with children and involve them in the family budget. It will give them a real example of what things may be omitted and what expenses are vital.

Encourage them to earn money

Parents may begin by giving their child a weekly allowance for doing certain chores around the house. Then the value of each pound will be appreciated.

Let them learn from their mistakes

It is important for children to learn from their mistakes. Even if they overspend their allowance, it will be a valuable lesson for them. They will understand the outcomes of their choice and avoid the same mistake in the future.

Tips to teach saving to children

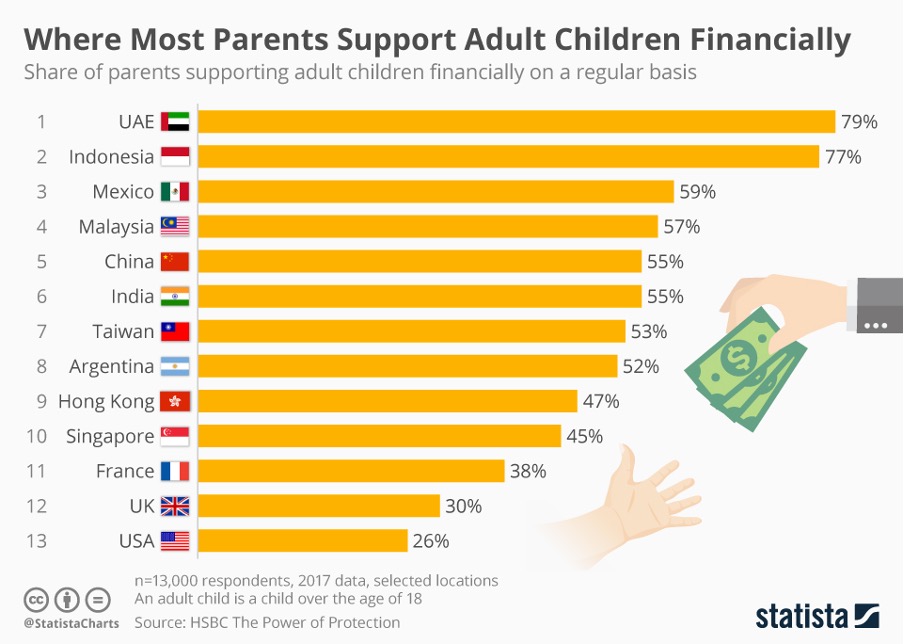

The share of parents supporting adult children by country chart published by Statista shows that the United Arab Emirates and Indonesia are the places where most parents support their adult children financially on a regular basis (79% and 77%, accordingly).

Source: https://www.statista.com/chart/18654/share-of-parents-supporting-adults-children-by-country/

According to the survey, half of the parents who claimed to support their adult child mentioned they had been doing so for over twelve years. The biggest part of financial aid from these parents goes to education expenses (59 percent) and daily living expenses (49 percent). Only 26 percent of parents in the USA support their adult children financially.

As it can be seen, it is equally important to teach children both budgeting and saving so that they can be financially independent later in their lives.

Set savings goals

It will be pointless to tell the child the importance of saving without talking about its reasons. Parents need to help their children determine their savings goals. This way, they will remain motivated and realise what is waiting for them if they are determined. For instance, if they want to purchase a new video game for £50 and receive a £10 weekly allowance, they will figure out how many weeks they need to save to achieve their goal.

Offer a place to save their money

Children need to have a certain place where they can stash their money. Once they have their own savings goal, parents may offer them a piggy bank or a savings account. They may get them a debit card for children if they are old enough and know how to use it. There are several cards suitable for children and teens that will help them make their savings goals and send parents notifications about their purchases.

Pretend to be their creditor

If parents want to teach their children about saving, the children should understand that it is essential to live within their means. Sometimes, a child may urgently want to buy some item and is impatient about setting money aside for this big-ticket purchase. In this case, a parent can act as a lender to teach about saving. They may lend the desired amount and demand payment from the child’s weekly allowance together with interest. The lesson from this situation is that waiting to save one’s own funds can help purchase the desired item for a lower price.

Be a good example for children

Parents may talk a lot about money management strategies with their children, but they should be a good example for them in the first place. Do they have their own emergency fund? How well can they budget? Do they set aside a percentage of their income in the retirement account? These actions will encourage children to save as well. Besides, a great plan is to save for an expensive purchase together as a family, such as for an upcoming holiday or a big-screen TV.

The bottom line

If parents do not want to support their children financially when they become adults, they need to teach their children about financial literacy. Budgeting and saving are two essential skills that will help children make smart monetary moves, pick the best lending options, save for near- and long-term goals, and avoid the vicious debt cycle.

The editorial unit

Facebook

Twitter

Instagram

YouTube

RSS